Australian Government Bonds - Bond Adviser

$ 20.50 · 4.8 (199) · In stock

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

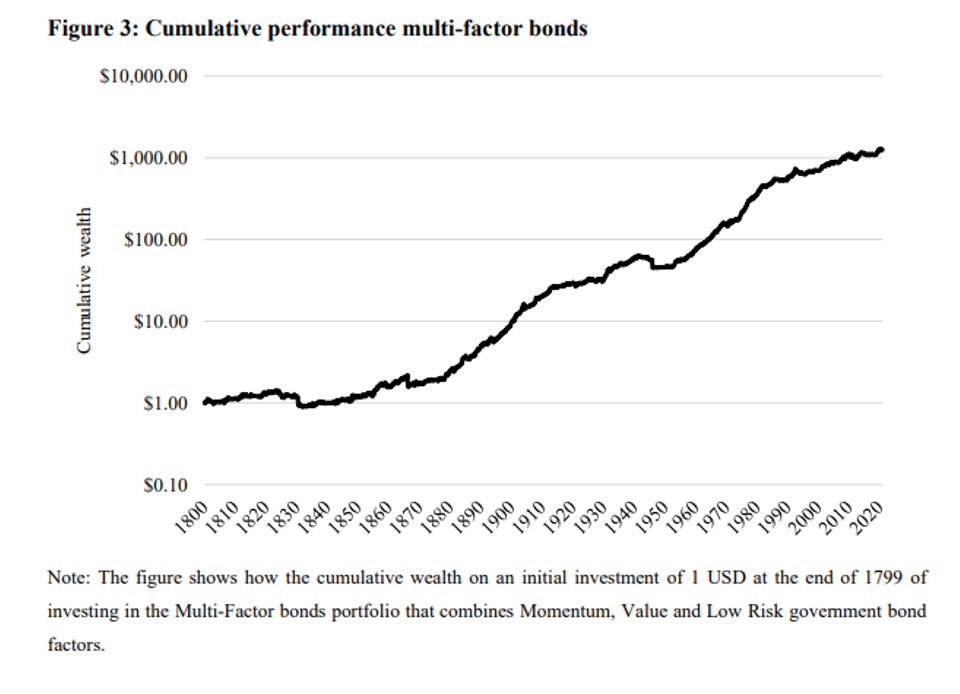

Factor Investing in Sovereign Bond Markets

You Can Use Your Tax Refund to Buy I Bonds, but Should You? - The New York Times

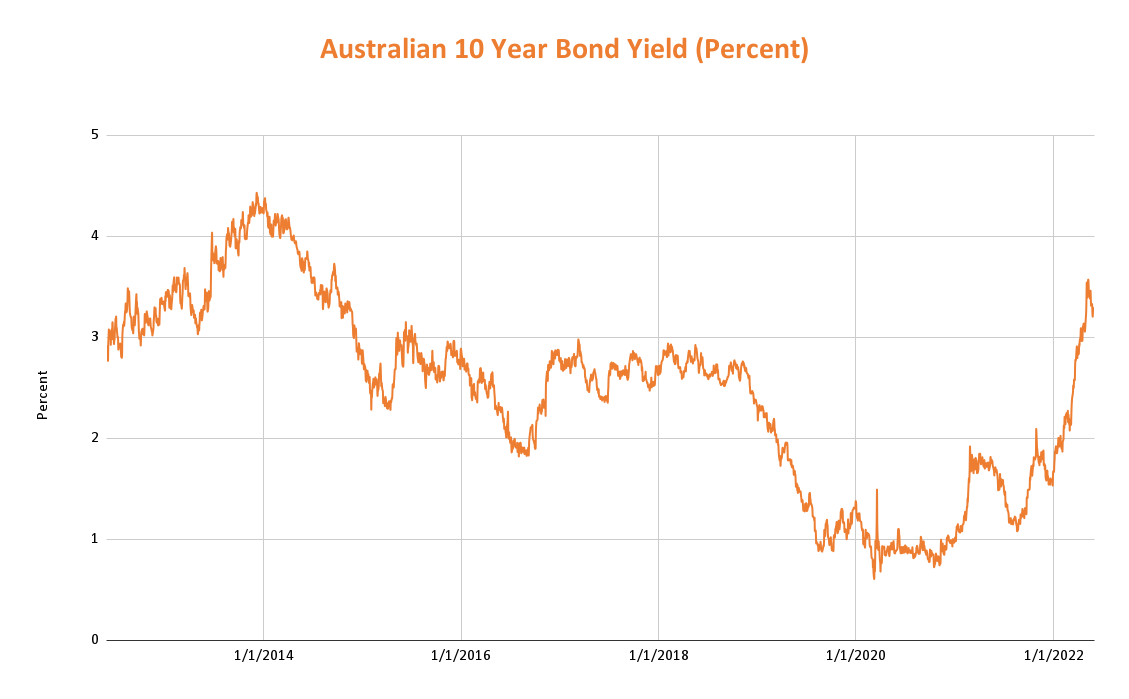

Why are Bond Yields High for Aussies? – Forbes Advisor Australia

How ETF bond ladders can help give client portfolios a boost

Government Bonds: What to Know and How to Invest

Vanguard Australia says bonds are the 'standout asset class

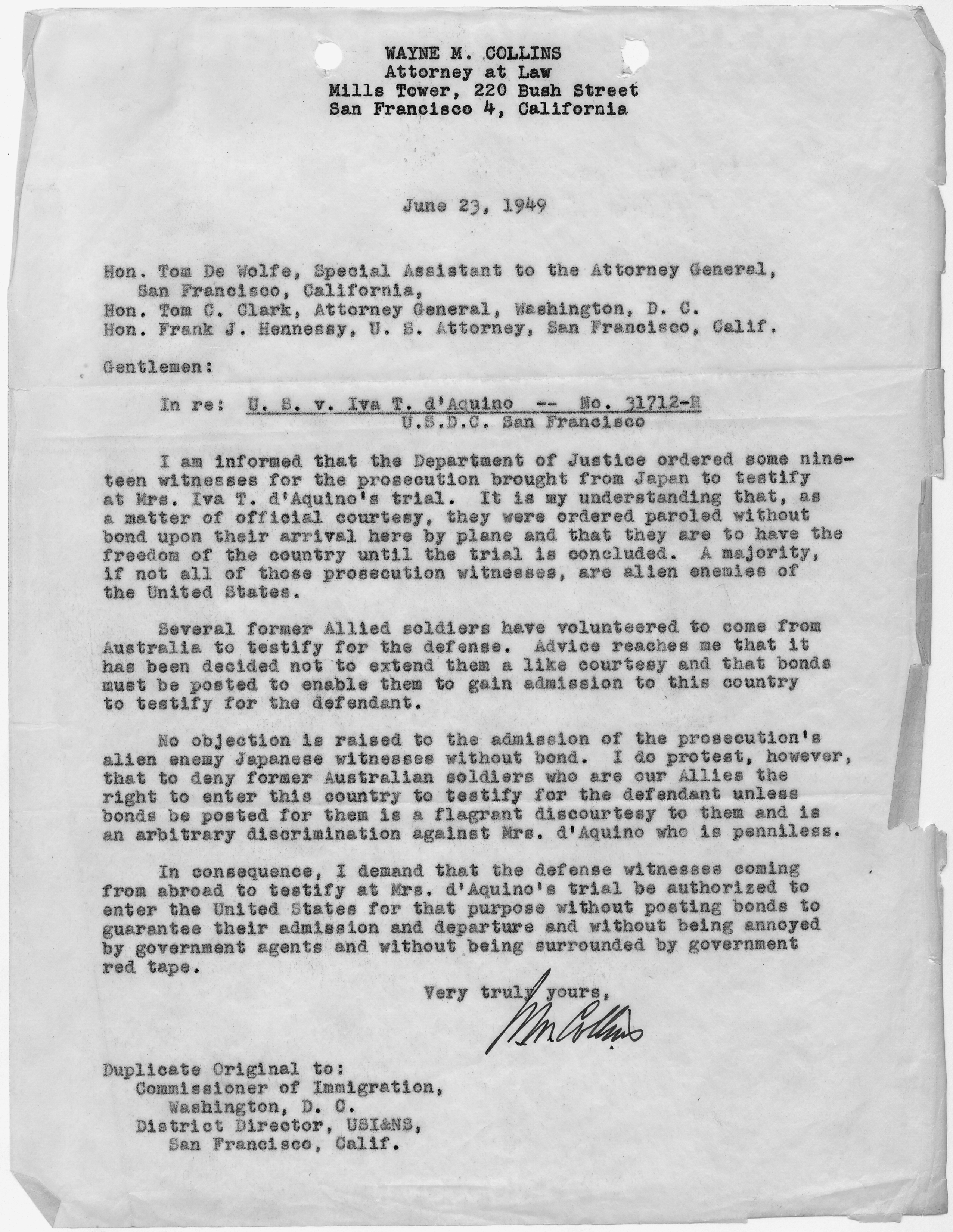

File:Letter from Wayne Collins, attorney for the defense, to Tom DeWolfe, Special Assistant to the Attorney General, et al. - NARA - 296670.jpg - Wikipedia

Bond yields are rising: Here's what it means for you

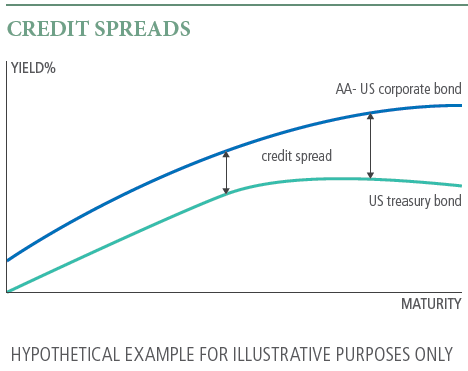

Understanding Corporate Bonds

Australian Government Bonds - Bond Adviser