Low-Income Housing Tax Credit Program

$ 11.00 · 5 (197) · In stock

The Fund is responsible for administering the Low-Income Housing Tax Credit Program, which generates low-income residential rental units by encouraging private investment through federal tax credits. Since its inception, this program has produced more than 17,200 affordable rental units in West Virginia. If you are interested in receiving updates on the Fund’s Low-Income Housing Tax […]

How to Better Leverage the Low-Income Housing Tax Credit Program for Affordable Rental Housing Production

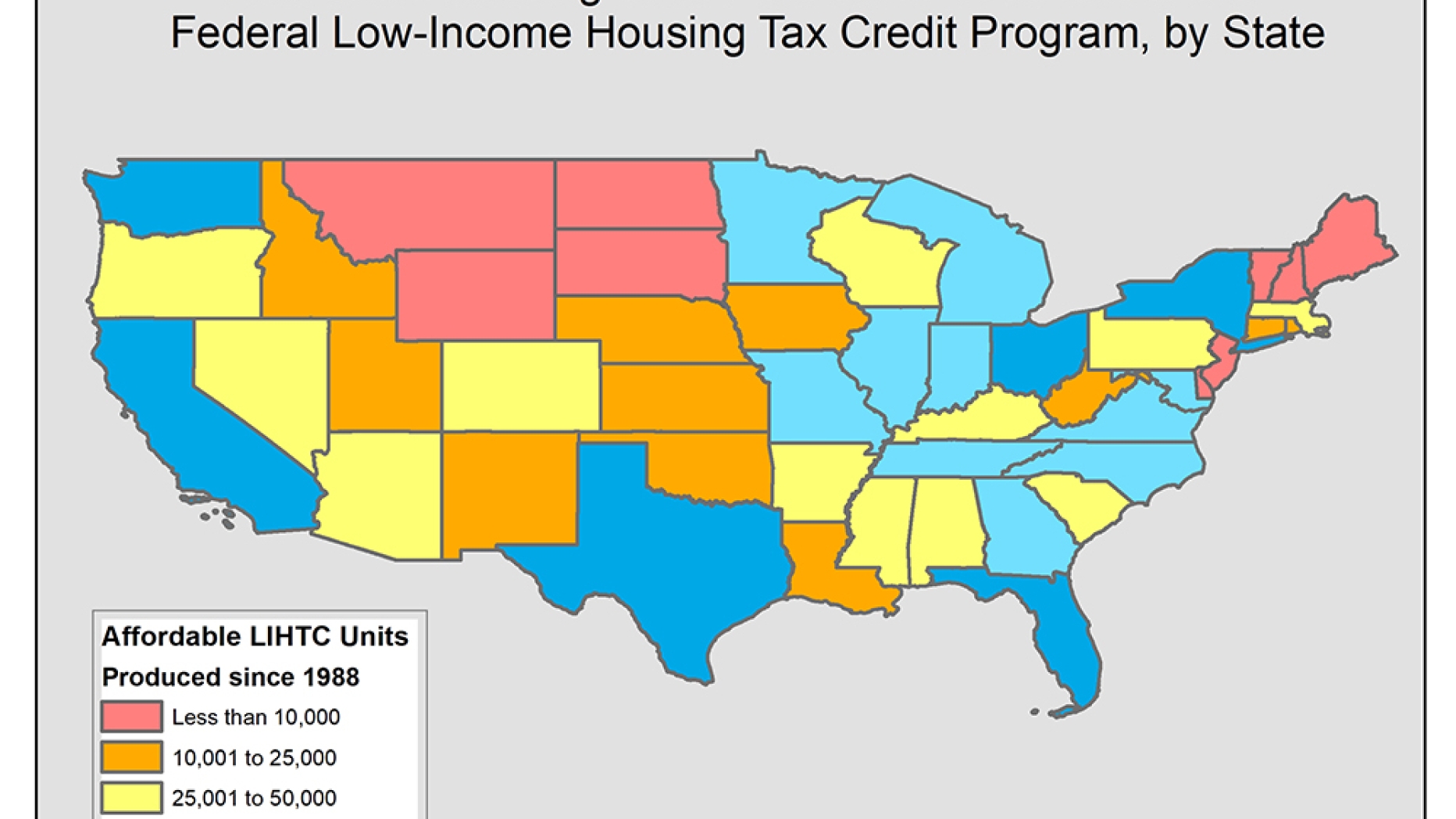

Improving the Spatial Equity of the Low-Income Housing Tax Credit Program

Low Income Housing Tax Credit Program - Keep Pushing Costs Back

Driving Community Impact with LIHTC

Housing Tax Credits Contributing To Chicago Segregation

Texas LIHTC housing program rocked by second earthquake in two

Low-Income Housing Tax Credit Program

Who Really Pays for Affordable Housing - Texas State Affordable Housing Corporation (TSAHC)

The Effects of the Low-Income Housing Tax Credit (LIHTC) – NYU Furman Center

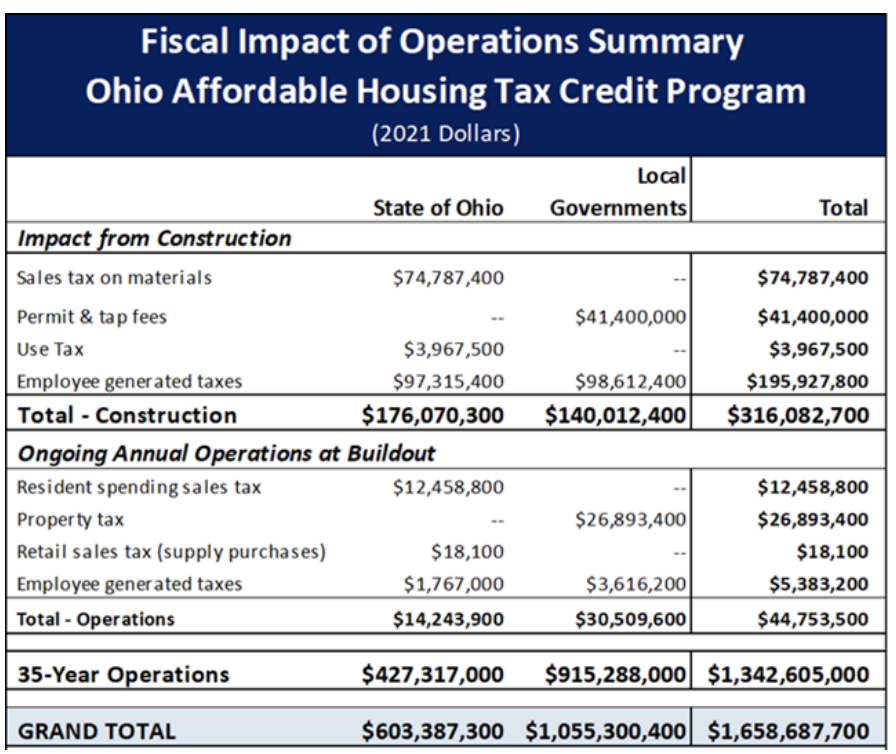

THE OHIO AFFORDABLE HOUSING TAX CREDIT PROGRAM: Creating Jobs While Solving Ohio's Affordable Housing Crisis

Low-Income Housing Tax Credits, NSP LLP

Low-income housing tax credits financial definition of low-income housing tax credits

The American Jobs Plan Would Mean Major LIHTC Expansion

Making the Most of the Low Income Housing Tax Credit for Veterans — NCHV Annual Conference

Low-Income Housing Tax Credit Could Do More to Expand Opportunity