Negative Return - Definition, Tax Treatment, Examples

$ 24.99 · 5 (591) · In stock

A negative return represents an economic loss incurred by an investment in a project, a business, a stock, or other financial instruments.

What is Negative Income Tax and How Does It Work

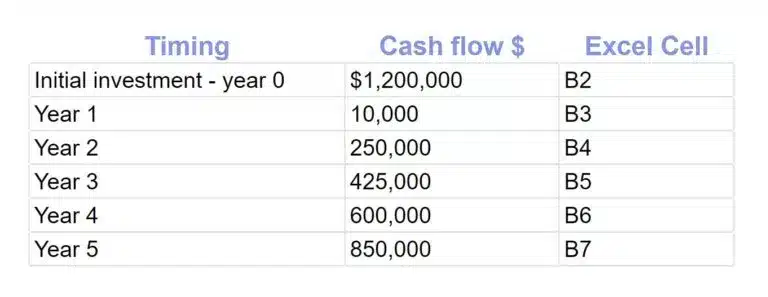

Internal Rate of Return (IRR): Definition, Formula & Example

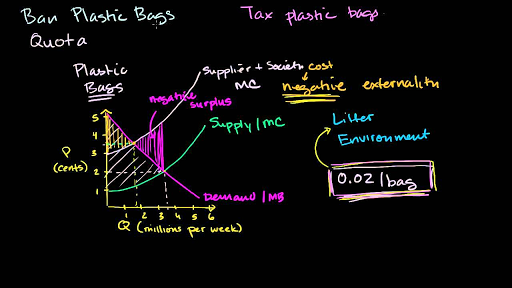

Taxes for factoring in negative externalities (video)

Income tax, Definition, Types, & Facts

Constructing the effective tax rate reconciliation and income tax

i.insider.com/610c089f2a24d0001861df9e?width=1136

Negative Cash Flow Explained - Why Is It Not Always Bad?

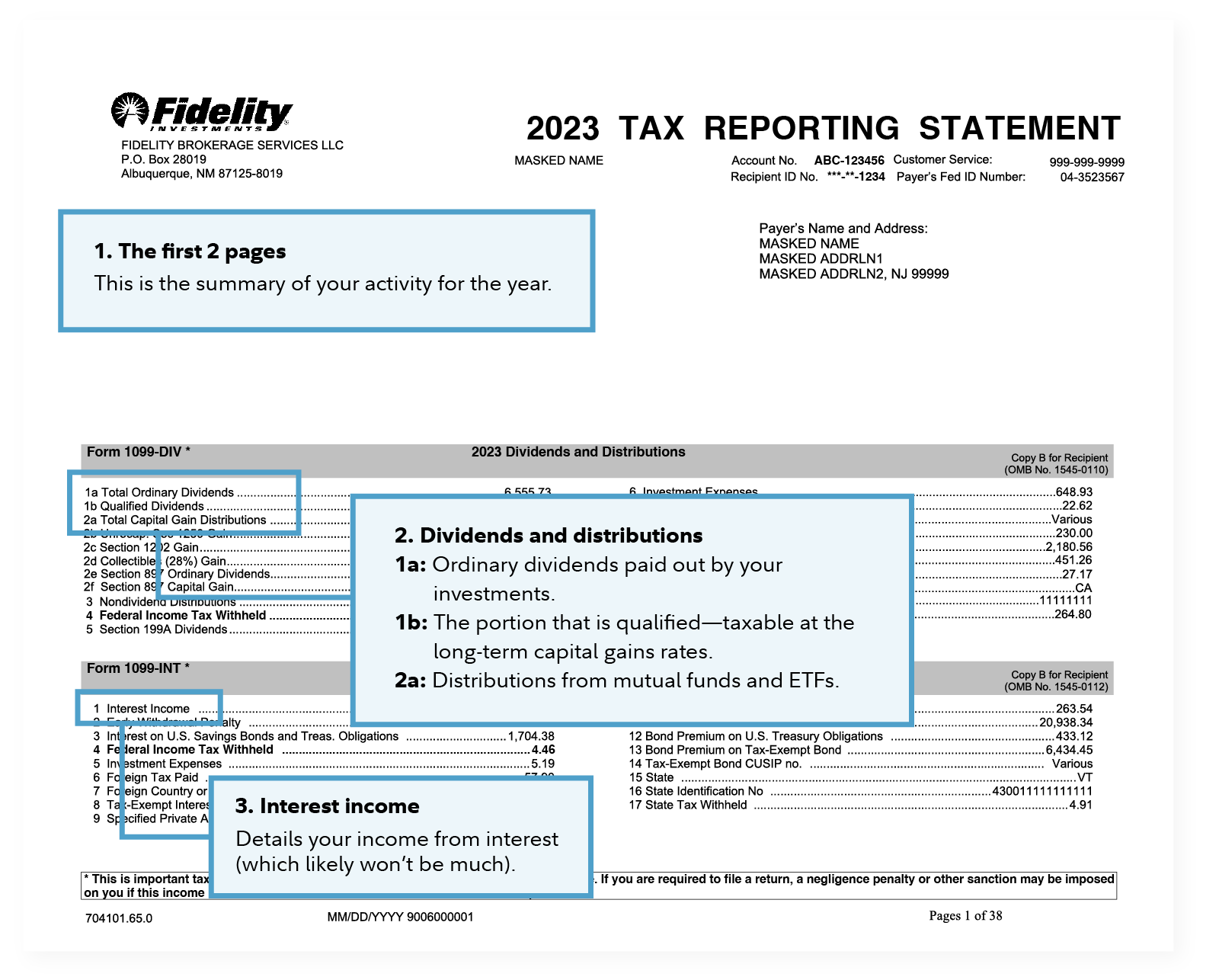

1099 tax form, 1099

How To Deduct Stock Losses From Your Taxes

Wash-Sale Rule: What it is and How to Avoid

Tax implications: Uncovering the Tax Treatment of Negative

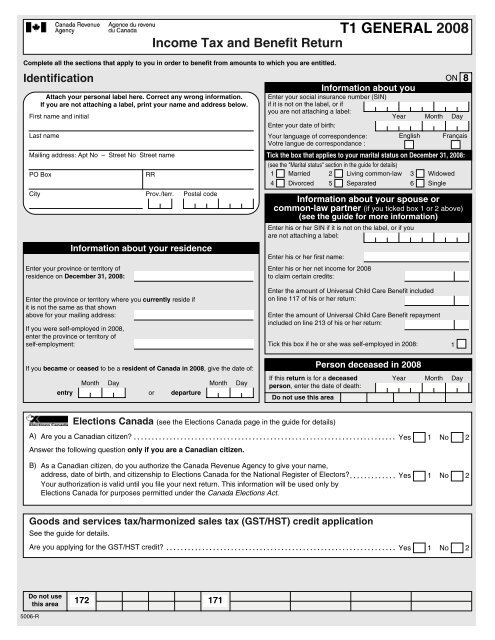

T1 General 2008 Income Tax and Benefit Return - Nevcon

Introduction to Total Return Swaps

Negative Return - Definition, Tax Treatment, Examples