How to calculate carry and roll-down (for a bond future's asset swap) –

$ 18.00 · 4.8 (338) · In stock

Bobl spread is 53.1bp, we are 3 months away from mar18 delivery, and a client blasts “what do you see as carry and roll for OE asw?”. Here are my notes on the mechanics of the calculati…

Riding the Yield Curve and Rolling Down the Yield Curve Explained

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

CFA Level 3 Fixed Income: Carry Trade with Bond Futures

Forward Rate Formula Definition and Calculation (with Examples)

On The Finer Details of Carry and Roll-Down Strategies - Moorgate Benchmarks

Mastering Carry Roll-Down with Leverage, by Secured Finance Official, Secured Finance

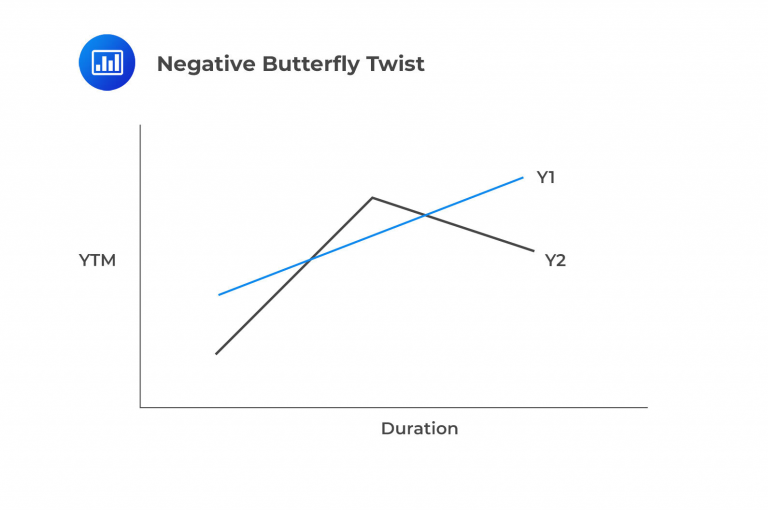

Yield Curve Strategies - CFA, FRM, and Actuarial Exams Study Notes

:max_bytes(150000):strip_icc()/backwardation.asp-final-66a475f384d04ac296eabc200556b64b.jpg)

Backwardation: Definition, Causes, and Example

Carry and Roll-Down of USD Interest Rate Swaps in Excel with Bloomberg Comparison - Resources

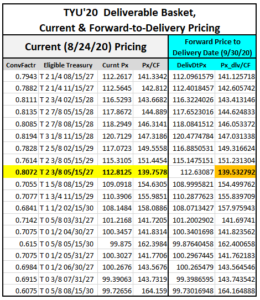

Understanding Treasury Futures Roll Spreads, Futures Brokers