What is the journal entry to record a foreign exchange transaction

$ 12.00 · 5 (147) · In stock

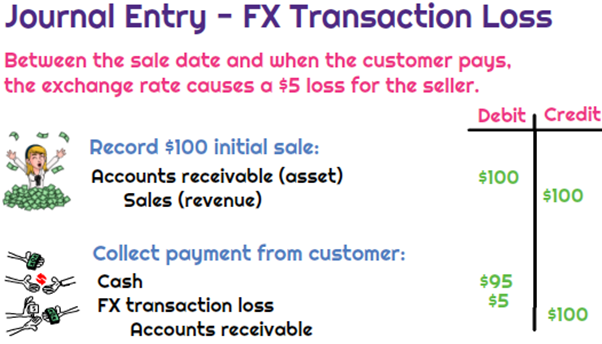

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Foreign Currency Transactions: Accounting and Reporting Practices

Foreign Exchange Gain/Loss - Overview, Recording, Example

What is the journal entry to record a foreign exchange transaction loss? - Universal CPA Review

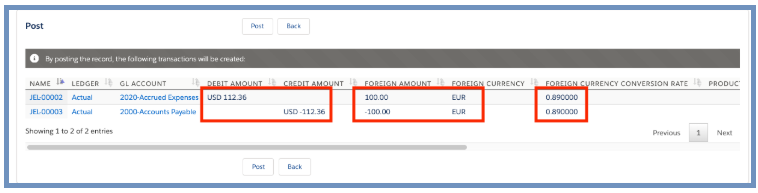

Example Multi-Currency Transactions – Accounting Seed Knowledge Base

How Does SAP Business One Manage the Foreign Currency Exchange Rate?

Simple Example for understanding Realized Forex Ga - SAP Community

Hedges of Recognized Foreign Currency–Denominated Assets and Liabilities - The CPA Journal

Accounting Entries For Foreign Exchange Transactions

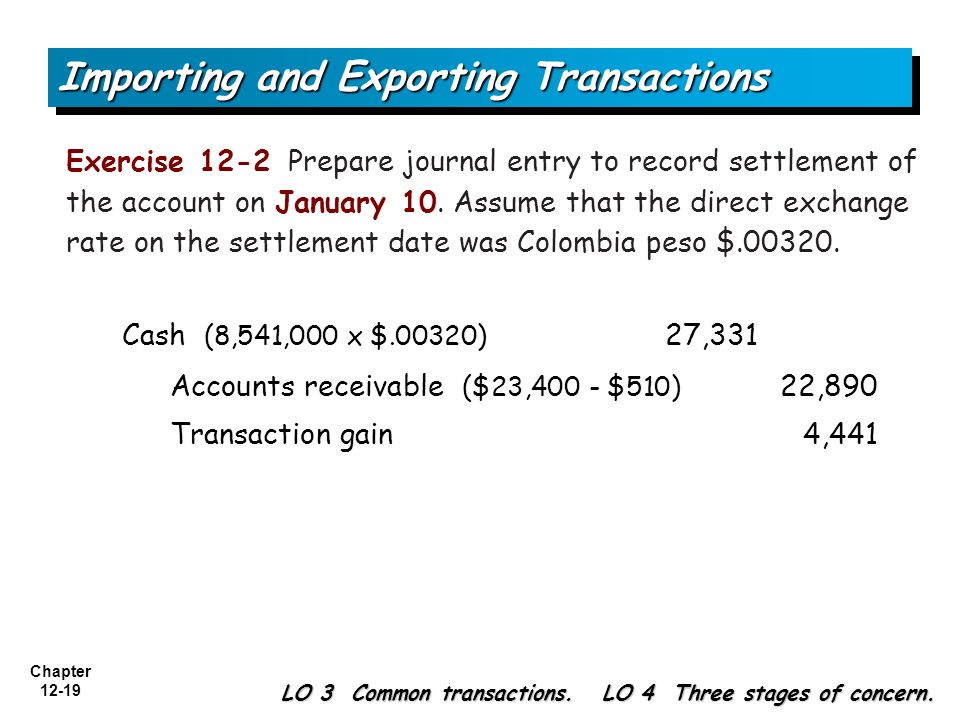

2 Accounting for Foreign Currency Transactions and Hedging Foreign Exchange Risk. - ppt video online download

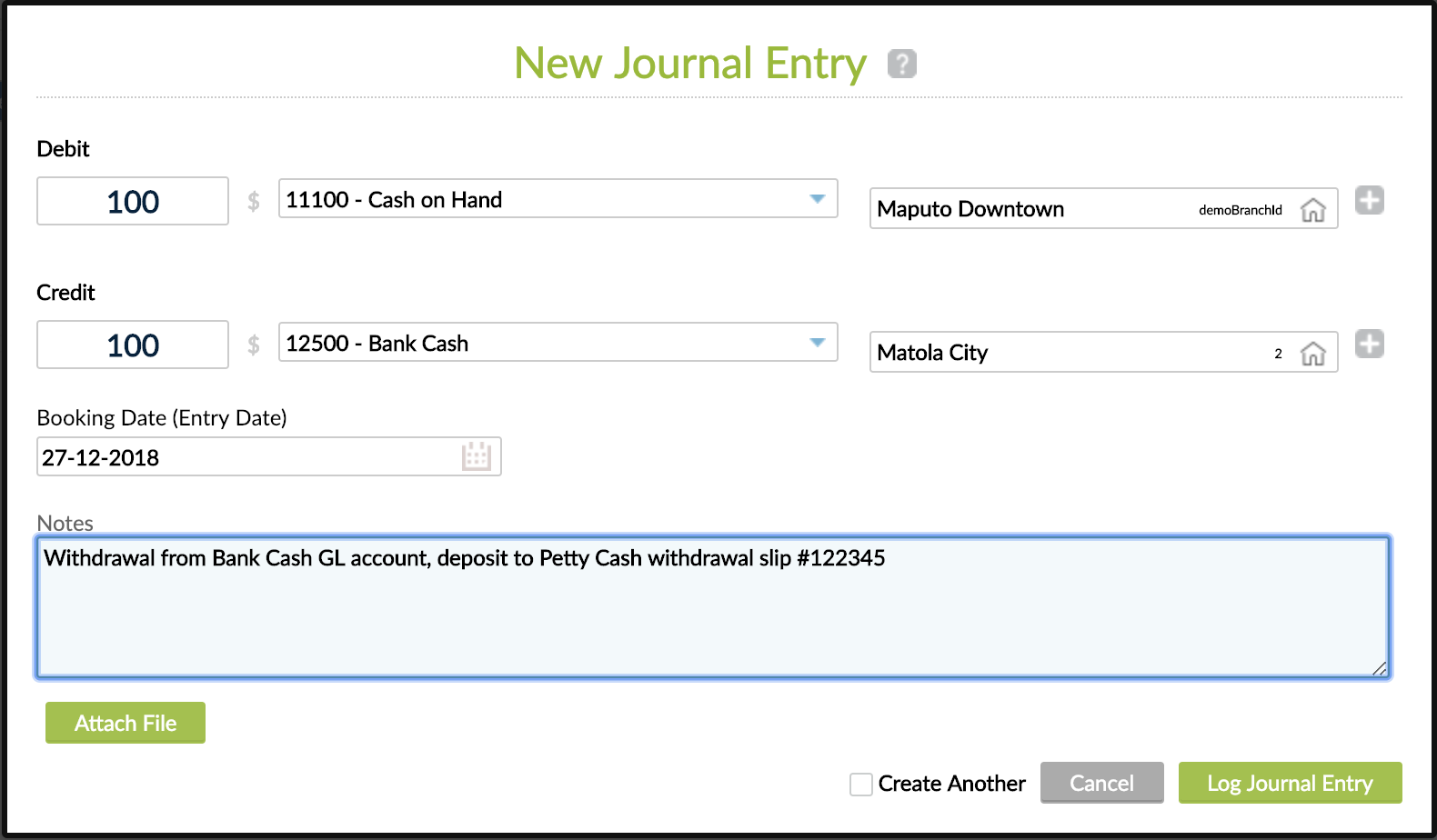

Journal Entries - Accounting